Sage 50 is a business software that offers various amenities to small and large-scale business enterprises to maintain their account records and automate various other tasks. One of the major accounting tasks is bank reconciliation in Sage 50, through which users can compare the bank account statement with other records in order to check out for any missing transactions or any other discrepancies. While reconciliation is a mandatory and clear-cut process, users sometimes face difficulties in doing the same.

Therefore, here we are going to tell you how to do a Sage 50 bank reconciliation. So check this narrative till the end in order to get all the available information on Bank reconciliation in Sage 50 and other details, which can be crucial for the users to know while using Sage 50 software.

Table of Contents

ToggleWhat is Bank Reconciliation

Reconciliation refers to the process of comparing a company’s bank account statement with its own financial records. The major intention behind doing a bank reconciliation is to check whether both the statements match and if there is no discrepancies in the records. Comparing transactions can make it easy to check out any missing transactions or even detect fraud in the account.

Reconciliation is a repetitive process. Users can do it monthly or even on a weekly basis, depending on the number of transactions done in a given period of time.

Also Read: Sage 50 Won’t Open Company Files

Basic Accounting Terms you need to know before starting the Sage 50 Bank Reconciliation Process

While doing a Bank Reconciliation in the Sage 50, there are some basic terms that you need to understand first in order to make the Reconciliation process swift and easy:

- Statement Date: This refers to the date of the last transaction or the end date in the bank statement of the account for which you want to do the reconciliation.

- Statement End Balance: This refers to the closing balance of the bank account statement.

- Total Received and Paid: It is the total value of the money out and money in, or we can say reconcile payments and receipts. The amount in this column gets an update with each transaction as the reconciliation proceeds.

- Starting Balance: It is the reconciled transaction total up to the current statement. It is also crucial to match the starting balance with the opening balance of the bank statement.

- Target End Balance: The statement end balance, which you need to match the reconciled balance.

- Reconciled Balance: This is the total of the reconciled balance and starting balance. During the Sage 50 Bank reconciliation, you need to make sure that the Reconciled balance matches the closing balance in the bank statement.

- Difference: It is simply the difference between the starting balance and the statement end balance. This value needs to be zero at the end in order for the reconciliation to be successful. Any net value in the difference would indicate outstanding balances or a Sage bank reconciliation discrepancy.

Set up the Bank Account for which you wish to do the Reconciliation Process.

The first thing you need to do is enable the Sage 50 Bank reconciliation for the account for which you need to compare the transactions. This can be done from the Chart of Account.

- Open the Sage 50 program where on the homepage, hit the option “Company” from the left-hand side panel.

- On the next window, click on “Chart of Account.” A pop-up will appear on the screen from which you need to select the bank account you want to enable for transactions.

- Afterwards, click on the tab “Bank and Reconciliation.”

- Check the box for the “Save Transaction for Account Reconciliation” and click on “Setup.”Through this, you can save various transactions (income and expense) for the account.

- A new window will pop up on the account titled “Account Reconciliation Linked Accounts.” Select various types of income and expenses of the account and other Sage bank reconciliation adjustments, which you want to link to this transaction.

The following income and expenses can be set:- Interest Income

- Exchange Gain

- Error Gain

- Adjustments.

- Bank Charges

- NFS

- Interest Expenses.

- Hit OK, which will save the changes.

How to do a Sage 50 Bank Reconciliation

Doing Banking Reconciliation is important for any company. Along with that, while making transactions through other applications like Sage 50 or any other, it becomes mandatory. The Banking Reconciliation process in Sage is a combination of more than one process,

which is listed below in chronological order.

- Set up a Bank Account in Sage 50.

- Provide Account Summary.

- Check the reconciled balance.

- Match/compare your transaction.

- Check out the Reconciled Reports.

All these steps have been discussed in detail in this blog post below. Also, before you initiate the bank reconciliations in Sage 50, make sure that you have entered all the transactions of your bank statement till your end date.

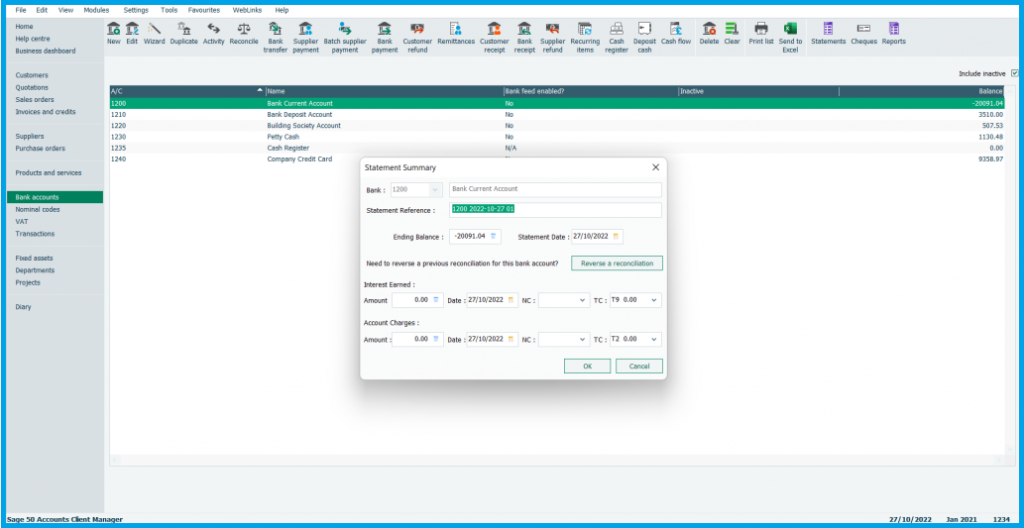

Statement Summary

First of all, you need to provide basic details of the bank statement for which you need to do the Reconciliation process. Fill out the following details:

- Ending Balance

- Statement Date

- Interest Earned

- Account Charges

While reconciliation is an easy and simple step process, users need to take additional actions in order to rule out any Sage Bank Reconciliation discrepancy during the bank reconciliation in Sage 50.

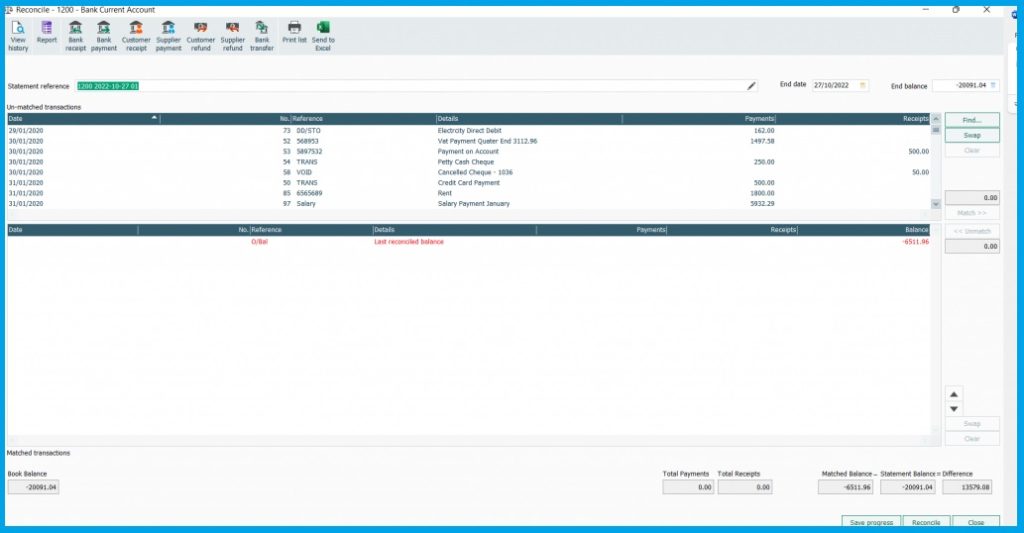

Check your Last Reconciliation Balance

The last balance, which was during the last reconciliation, should match the opening bank balance. To ensure this, navigate to the Mathced transaction window and compare the last reconciled balance. If it matches, then proceed further to the reconciliation. In case it doesn’t match, then you need to find the reason why.

The following are possible causes why a transaction doesn’t match with the bank account and can cause Sage 50 Bank Reconciliation Error.

- A transaction that you have reconciled has been either moved to a different bank account or has been deleted or amended.

- Other banking transactions have been reconciled since the last banking reconciliation have been done.

- An opening balance has been posted to your bank account.

Reconcile Your Account

Proceeding further, you need to follow the given steps to start the Bank Reconciliation.

- On the left side menu, hit the option “Banking” and then click on “Reconcile Accounts.”

- A pop-up window will appear on the screen titled “ Reconciliation and Deposits.” On this window, select the account you want to reconcile for. After that, fill out the given entries.

- Statement Start and End Date.

- Reconciliation Date.

- Statement Opening and End Balance.

- You can also add any outstanding amount through “Add Prior Outstanding” and then hit OK.

- After that, various transactions done within the given period will appear on the screen. Based on the category you have chosen (Income, Expenses, Worksheets, Transactions), the following entries will appear on the screen:

- Source (Cheque No. or the type of transaction)

- Deposit No.

- Date of Transaction

- Deposit and Withdrawal

- Status (Cleared, Outstanding)

- Below the transaction, you can check for the following entries:

- Resolved

- Discrepancy

- Outstanding

- Unresolved

- Now, go to the reports column and hit the option “Display Account Reconciliation Journal Entry” or simply press “Ctrl+J.”

What to do if the Last Reconciliation Balance Does not match

You can take the following measures in case of an unmatched Banking balance:

Check for other Reconciled Transactions since the Last Bank Reconciliation

You need to lookout for any reconciled transactions since the last transactions were done in your account. The steps for that are as follows:

- On the Sage homepage, go to bank accounts and select the account for which you need to make the transaction.

- Hit the option “Reports” and then click on Reconciled Transactions.

- Select Retrospective Bank Reconciliation and then hit on Preview.

- Select the date range for the last reconciliation, which should be 31-12-2099.

Wait for the report; if it appears, then the transaction has been done, or if the report doesn’t open, then it is an indication that no reconciliation has been done.

Find the Balance Last Agreed

- Click on Bank Accounts and then select the account for which you need to check the transaction.

- Afterward, hit the given options:

- Reports/Reconciled Transactions/Retrospective Bank Reconciliation/Preview

- Now, you need to select a date range, which should be from 01/01/1980 to the last reconciliation date. Now, click OK.

- Here, you need to check whether the report total matches the last reconciled balance.

- Also, you have to check whether the balance at the end of the previous reconciliation matches the closing balance.

If they match, then proceed to the next step. If it doesn’t match, then you need to repeat the process through the previous reconciliation until the balance was last agreed.

Identify the transaction due to which there is a difference

One way to do that is to check for the previous reconciled transaction that has been deleted. For this, you need to follow the given steps:

Check Unreconciled Transaction Report

Through Unreconciled, users can check various bank transactions that have not been reconciled as of a specified date. Follow the given steps to view a Unreconciled Transaction Report:

- On the Sage 50 home screen, select the option Reporting. There, under the section Cash Report, hit on Unreconciled Bank Transaction.

- Select the bank account for which you wish to make an unreconciled transaction report.

- Provide end date of the report in the “To” menu. After that, you can see the bank balance and the reconciled balance. In case of any difference, it means that the transactions listed under the given date in the “To” column have not been reconciled.

- Click on the transaction to check the details of the transaction.

- You can save the unreconciled report or take a printout of it. For this, hit “Export” and then select the file format (CSV or PDF).

Ending it Up

Bank Reconciliation is a mandatory task that needs to be done regularly in order to match and compare the bank statement with your own financial records. The reconciliation is a very swift and easy process. All you need to do is select the bank account and provide the required details like the Statement date and the closing balance. Afterward, you can easily check and compare the transactions made during that period and point out any discrepancies or outstanding balances.

If you are still facing any issues or error while doing Bank Reconciliation, you can contact on our mentioned Sage 50 Technical Support Number. Our expert will answer to queries instantly.

Frequently Ask Questions (FAQs)

It refers to the process where user can check and compare their bank account statement with their own financial records. While many business relies on different business software for their accounting, it is a mandatory feature that needs to be present in business software to check for any missing transaction, outstanding balance or even discrepancies or fraud.

Users with Sage 50 as their business software need to first enable the reconciliation for the bank account of which they need to do the reconciliation. This can be done from the Chart of Accounts. Afterward, they can go to the banking option and hit on “Account Reconcile,” where they can select the account and start the reconciliation process.

There might be some deleted transactions, or the user might have selected the wrong account, due to which it is unable to show the transaction or even do the reconciliation process.

Numerous reasons can be there due to why the last reconciliation balance does not match the bank opening balance:

- Deleted transaction, amended transaction or has been moved to a new account.

- Any other reconciled transaction has been done since the last reconciliation.

- The opening balance has been posted to the bank account.

You can take the following measures in case the transaction does not match:

- Check whether the balance now and balance last agree.

- Detect the transaction that is causing the difference or check for any deleted transaction.