Settlement discounts are a common practice in business transactions, offering a discount to customers if they pay their invoices within a specified period. However, there are instances where the settlement discount might need to be reversed, leading to the concept of a “Reverse Settlement Discount.” In Sage 200, understanding and effectively managing reverse settlement discounts is crucial for maintaining accurate financial records. This blog will explore what a reverse settlement discount in Sage 200 is, why it might be necessary, and how to do this in Sage 200.

You must call our Sage support team at +1 (866) 430-0630 for immediate and professional support. Our team of experts will guide you through everything about reverse settlement discounts in Sage 200.

Table of Contents

ToggleWhat Does the Settlement Discount in Sage 200 Mean?

A Settlement Discount in Sage 200 is a financial incentive offered by a seller to a buyer for early payment of an invoice. This discount encourages prompt payment, improving cash flow for the seller. In Sage 200, the settlement discount functionality is integrated into the accounts receivable and payable modules, allowing businesses to manage and apply these discounts efficiently.

Also Read: Fix Sage 300 Error 49153

Understanding What is Reverse Settlement Discount in Sage 200

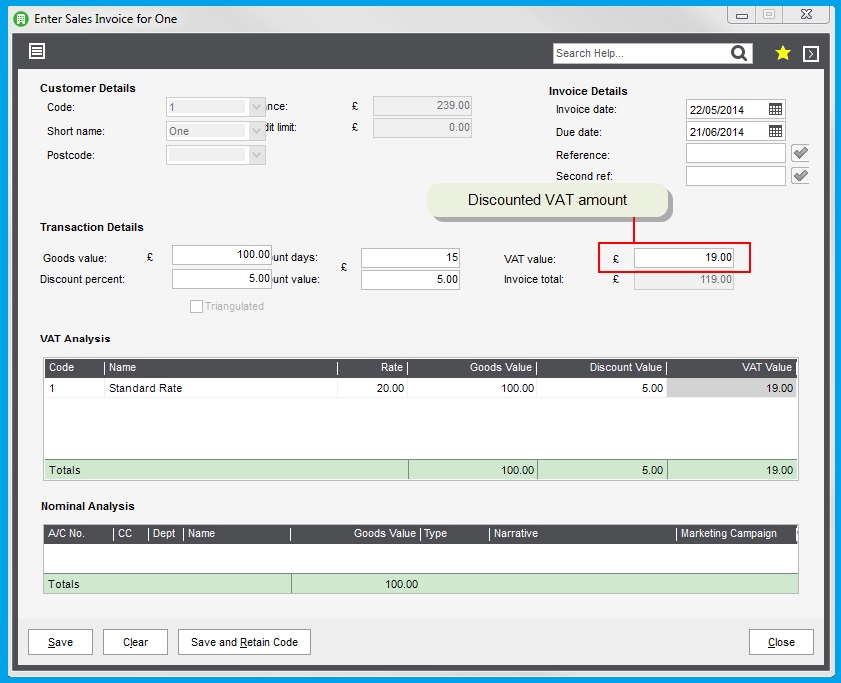

A Reverse Settlement Discount in Sage 200 refers to the process of undoing a previously applied settlement discount. This is necessary when the conditions for the discount are no longer met, such as when a customer fails to pay within the specified discount period, makes a partial payment, or when an error in applying the discount is discovered. Reversing the settlement discount ensures that financial records accurately reflect the true amounts due and received.

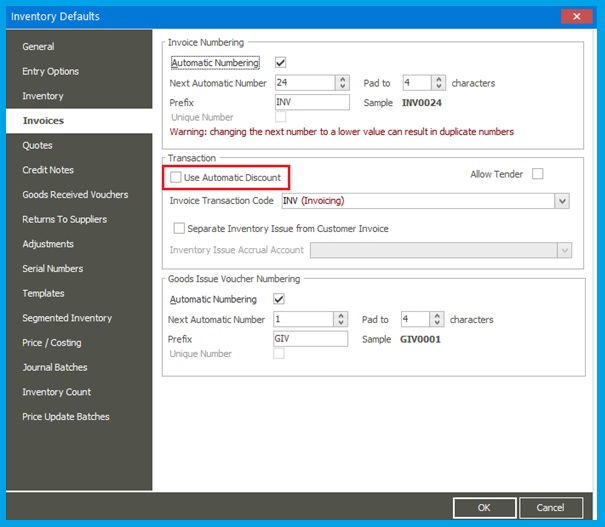

Steps to Reverse Settlement Discount in Sage 200

Reversing a settlement discount in Sage 200 involves several steps to ensure that the financial records are accurately adjusted. This process is necessary when a settlement discount is applied incorrectly or when the conditions for the discount are no longer met. The below step-by-step guide will help you reverse settlement discount in Sage 200:

- First of all, move to the ‘Financials’ module within Sage 200. Now, depending on whether you are dealing with a customer or supplier, choose the Sales Ledger or Purchase Ledger.

- Next, you must search for the specific invoice to which the settlement discount was originally applied. (You can search by date, amount, or customer/supplier name.)

- Now, open the payment transaction that contains the settlement discount. Also, you must make sure that the correct transaction has been found for the reversal.

- Following this, you need to move to the ‘Journals’ section in the Financials module. Here, you must select the option to create a new journal entry.

- Afterward, enter the reversal details, and locate the customer or supplier account that needs adjustment in the Sales Ledger or Purchase Ledger.

- Done? Now, adjust the balance to reflect the reverse settlement discount in Sage 200.

- Lastly, you need to ensure the correct journal entries are posted to the General Ledger and run the updated financial reports to confirm the reversed settlement discount in your Sage 200.

How to Reverse Payment in Sage 200?

Reversing a payment in Sage 200 is a process that involves several steps to ensure that the financial records are accurately adjusted. This may be necessary if a payment was applied incorrectly, if a payment needs to be undone due to an error, or if the payment is disputed. Take a look at the below step-by-step guide on how to reverse a payment in Sage 200:

- Firstly, navigate to the ‘Financials’ module within Sage 200.

- Next, choose either the Sales Ledger (for customer payments) or the Purchase Ledger (for supplier payments).

- Now, locate the specific payment transaction that needs to be reversed. You can find this by date, customer/supplier name, amount, or any payment reference.

- Afterward, open the payment transaction to review its details. Also, make sure you have the correct payment that needs to be reversed.

- Following this, move to the ‘Journals’ section in the Financials module and select the option to create a new journal entry.

- Here, you must debit the account that was credited when the payment was originally recorded. Moving on, credit the account that was debited when the payment was originally recorded. In addition, you must make sure that the amounts match the actual payment to correctly reverse payment in Sage 200.

- Now, go back to the Sales Ledger or Purchase Ledger and locate the customer or supplier account.

- Afterward, adjust the balance to reflect the reversed payment and update the financial records.

- Finally, verify the journal entries and start running the financial reports.

Quickly Learn How to Reverse a Purchase Invoice in Sage 200

Certainly, reversing a purchase invoice in Sage 200 helps users ensure that the transaction is correctly undone. Also, it helps users make sure that the financial records remain correct and error-free. The below stepwise guide on how to reverse a purchase invoice in Sage 200 will help you:

- You must start this procedure by first moving to the ‘Financials’ module within Sage 200.

- Next, select the ‘Purchase Ledger’ to access supplier accounts and search for the specific purchase invoice that needs to be reversed.

- Following this, open the purchase invoice to review its details and ensure you have selected the correct transaction.

- Now, create a credit note that mirrors the original purchase invoice. This credit note will effectively cancel out the original invoice.

- Moving on, navigate to the ‘Purchase Ledger’ and select the option to create a new credit note.

- Furthermore, enter the details of the original invoice into the credit note, including the same supplier, date, amount, and description.

- Here, you must ensure that the credit note is correctly posted to the supplier’s account. This step will reverse the effect of the original invoice on the accounts payable and the expense accounts.

- Now, you must verify that the supplier’s account balance reflects the reversal of the invoice.

- Also, make sure that the credit note has been applied against the original invoice to zero out the balance.

- Finally, you must generate updated financial reports, such as the aged creditors report and the general ledger, to ensure that the reversal is accurately reflected.

- In addition, you must confirm that the accounts payable and expense accounts have been adjusted correctly.

How Can I Reverse Charges in Sage 200?

To reverse charges in Sage 200, you must undertake the steps given below and make sure that the financial records are accurately adjusted. Have a look:

- Firstly, you must access the relevant ledger (Sales or Purchase) in the ‘Financials’ module.

- Now, search for the specific charge transaction and open the transaction to ensure accuracy.

- Following this, navigate to the ‘Journals’ section and create a new journal entry, debiting the originally credited account and crediting the originally debited account.

- Here, you must make the necessary adjustments in the account balance by searching for the customer or supplier account in the relevant ledger.

- Right after this, continue to adjust the balance to reflect the reverse charges in Sage 200.

- Afterward, make sure that the journal entries are posted to the General Ledger, and finally, run financial reports to confirm the reversed charges.

How to Correct a Transaction in Sage 200?

Correcting a transaction in Sage 200 is essential to make sure that the error is rectified and the financial records are accurate. If you’re looking to correct a transaction in Sage 200, start performing the steps below:

- You must begin this method by first assessing the Financial module and choosing the relevant ledger (Sales or Purchase).

- Next, you need to locate the specific transaction that you wish to correct. Following this, search for the specific transaction to correct.

- Following this, open the transaction and verify its details. Once done, now you must decide whether to reverse the transaction or adjust the amounts.

- Afterward, reverse or adjust the transaction in Sage 200 by creating a journal entry to reverse the original transaction.

- Now, debit the originally credited account and credit the originally debited account, followed by posting the reversal.

- In the next step, you must create a new transaction entry to correct the amounts and post the adjustment.

- Finally, to successfully correct a transaction in Sage 200, finish this process by updating the account balance and financial records.

Reasons Why You Must Reverse Settlement Discount in Sage 200

The reverse settlement discount in Sage 200 occurs when a previously applied settlement discount needs to be reversed. Several situations might necessitate this action, including:

- Payment After Discount Period: If a customer pays the invoice after the discount period has expired but the discount has already been recorded, the discount must be reversed.

- Partial Payment: If a customer only makes a partial payment within the discount period, the full discount may have been applied incorrectly, requiring an adjustment.

- Disputed Invoices: If an invoice is disputed and later resolved, the initially applied discount may need to be adjusted.

- Return of Goods: If goods are returned after the discount has been applied, the discount on those returned goods needs to be reversed.

Also Read: Integrate General Ledger in Sage 300

For Further Help, Connect With Our Sage Experts!

As noted above, reverse settlement discounts are an essential aspect of financial management, ensuring that your records accurately reflect your business transactions. In Sage 200, managing these reversals is straightforward with the right approach and understanding. By following the steps outlined in this blog, you can ensure that your financial records remain accurate and your customer accounts are correctly balanced. Still if you’ve any queries or need further professional help, just reach out to us via Live Chat Support!

Frequently Ask Questions (FAQs)

A reverse settlement discount in Sage 200 is typically the process of undoing a formerly made discount. It is due to incorrect application or unmet conditions.

You should reverse a settlement discount if the payment was made after the discount period, if there was a partial payment, or if there was an error in applying the discount.

Access the ‘Financials’ module, select the relevant ledger, and search for the specific transaction by date, amount, or customer/supplier name.

Review the original transaction, create a journal entry to reverse the discount, and adjust the account balance. Afterward, update financial records, and notify the relevant party.

Yes, you can reverse a partial settlement discount by adjusting the journal entries and account balances to reflect the correct amount.