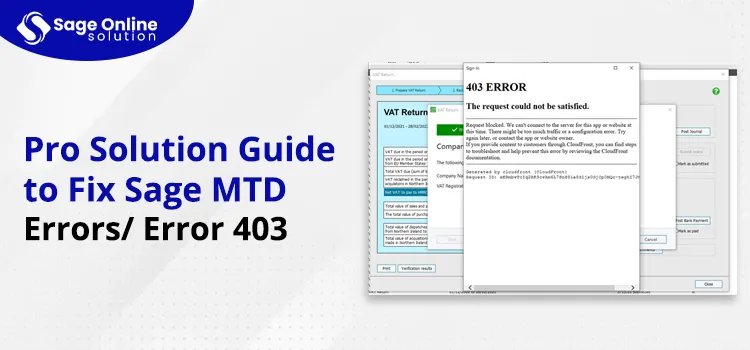

Sage, a popular accounting software, supports MTD compliance by allowing users to submit VAT returns directly to HMRC. However, users may encounter errors during this process, with Error 403 being a common issue. Do you face the same Sage problem? If so, this blog will explore the causes of the same and provide solutions to fix Sage MTD errors/error 403. But before proceeding, let’s have a quick discussion on what the MTD is all about.

Are you looking for professional help while facing Sage problems like error code 403? If so, do not worry! Just ring our Sage support team at +1 (866) 430-0630 and get instant help.

Table of Contents

ToggleA Brief Introduction to Sage MTD

Making Tax Digital (MTD) is a UK government initiative designed to modernize the tax system, making it easier for individuals and businesses to keep their tax records and submit returns digitally. Sage, a leading provider of accounting software, supports MTD compliance by enabling users to manage their finances efficiently and submit VAT returns directly to HMRC through the software.

By integrating MTD features, Sage helps businesses maintain accurate, real-time financial records, reducing errors and ensuring compliance with HMRC’s digital requirements. This streamlines the tax filing process, providing a more seamless and transparent way to handle tax obligations.

Also Read: Resolve Email SMTP Authorization Errors

What Does the Sage MTD Errors or Error 403 Mean?

Sage MTD (Making Tax Digital) errors are issues that users encounter when submitting VAT returns or accessing HMRC services through Sage accounting software. Common errors, like Error 403, typically indicate authorization or permission problems, where the user or agent is not authorized to access the requested resource. Eventually, Sage users get Clients or Agent not Authorized messages. Now, why this error occurs is discussed in the next section. Continue reading.

What are the Common Causes of SAGE MTD Errors?

Below, we have explained some of the common causes of Sage MTD errors. Have a look:

- Invalid HMRC Credentials: Incorrect or expired HMRC login credentials can prevent Sage from connecting to HMRC’s servers, leading to errors during VAT submissions.

- Insufficient Permissions: The user account may lack the necessary permissions to access and submit VAT returns through MTD, resulting in authorization errors.

- Expired Authorization Token: Sage users may often encounter the MTD errors, due to the expired authorization token. This token basically allows Sage to interact with HMRC’s systems, which may expire, necessitating reauthorization.

- Incorrect Sage Configuration: Misconfigured settings within Sage, such as incorrect VAT registration numbers or outdated software versions, can trigger MTD errors.

- Network Issues: Unstable or improperly configured network connections, including firewall or antivirus settings blocking Sage’s access to HMRC servers, can cause communication failures and errors.

- Software Bugs: One of the common reasons for receiving clients or agent not authorized messages or error code 403 is the occasional bugs or glitches in the Sage software. These can lead to unexpected errors during the MTD process.

- HMRC Service Issues: Temporary outages or maintenance on HMRC’s end can also result in MTD errors/error 403, as Sage cannot connect to the necessary services.

Stepwise Solutions to Fix Sage MTD Errors/ Error 403

Sage MTD Error 403 typically indicates a “Forbidden” error, where the server refuses to fulfill the request due to permission issues. Here are detailed solutions to fix Sage MTD Errors/Error 403:

Fixing Step 1 – Verify HMRC Credentials

The first method to resolve MTD errors or Error 403 is to ensure that the HMRC credentials used in Sage are correct. For this:

- You need to first verify that the HMRC login details are correct. For this, log in to the HMRC website directly to ensure the credentials are valid.

- The next step is to renew your credentials. If your credentials have expired, immediately update them in your Sage software.

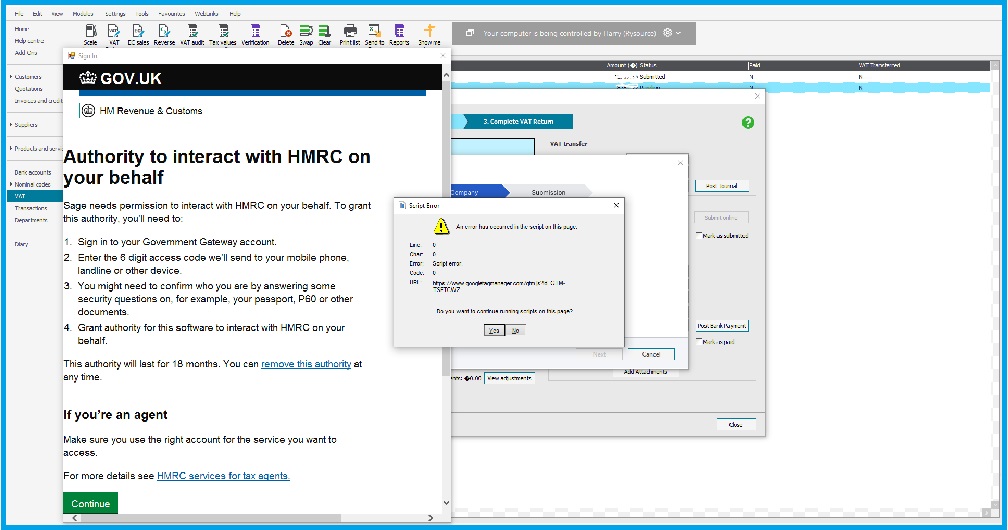

Fixing Step 2 – Ensure Proper Permissions

You need to make sure that your user account has sufficient permissions to submit VAT returns through MTD. Otherwise, it may lead to issues like MTD errors/error 403. Perform the below instructions:

- Check HMRC Account Settings: Firstly, you need to log in to your HMRC account and ensure that the user has the appropriate permissions to access MTD services.

- Update User Roles in Sage: Now, within your Sage software, you must ensure that the user role has the necessary access and permissions to submit VAT returns. You can do this via Sage’s user management settings.

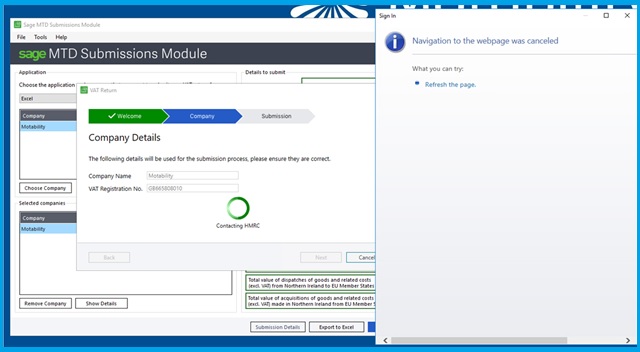

Fixing Step 3 – Refresh Authorization Token

As noted above, if the authorization token used to access HMRC services has expired, it may trigger MTD errors or error 403. But, by refreshing the token, you can resolve this error 403. Perform the below steps to refresh the authorization token:

- Reauthorize Sage with HMRC: In your Sage software, navigate to the MTD settings and reauthorize the connection with HMRC. Following this, it will generate a new authorization token.

- Update Token in Sage: Additionally, you must make sure that the new token is updated in your Sage software settings.

Fixing Step 4 – Check your Sage Software Configuration

Incorrect settings in the Sage software are also one of the common causes of Sage MTD errors or error 403. Therefore, you must verify and correct the Sage software configuration as needed. Here’s how you can do so:

- MTD Settings: Firstly, ensure that the MTD settings in Sage are correctly configured. It includes checking the VAT registration number and other relevant details.

- Software Updates: In addition, make sure that Sage is updated to the latest version. Sometimes, updates include fixes for known issues, and this can help you fix Sage MTD errors/error 403.

Fixing Step 5 – Resolve the Network Connectivity Issues

Sometimes, even the network connectivity problems can cause Error 403. Therefore, you must check your network connection and settings and fix them if needed. Take a look at the given instructions:

- Internet Connection: To avoid or fix Sage MTD errors/error 403, you need to make sure that the computer on which you’re running Sage has a stable and reliable internet connection.

- Firewall and Antivirus Settings: Additionally, you must check the settings for your firewall and antivirus software. Confirm they are not blocking Sage from accessing the HMRC servers.

- Network Configuration: Also, if using a corporate network, consult with your IT department to ensure there are no network issues preventing Sage from connecting to HMRC.

Also Read: Transfer Credit Balance from One customer to Another

Preventive Measures to Avoid or Fix Sage MTD Errors/Error 403

To avoid Clients or agent not authorized issues or Sage MTD-related errors, you must consider the following preventive measures:

- Regularly Update your Sage Software: Keeping Sage software up to date can prevent many issues, including MTD errors. Additionally, regular updates ensure that you have the latest features, security patches, and bug fixes.

- Timely Monitor your HMRC Account: It’s advised to timely monitor your HMRC account to ensure that your credentials and permissions are up to date. In addition, it includes periodically logging in to check for any notifications or required actions.

- Maintain a Stable Network Environment: A stable network environment is crucial for uninterrupted access to HMRC services. Besides, you must confirm a reliable and strong internet connection to prevent disruptions.

Ask Our Support Experts for More!

Sage MTD Error 403 can be frustrating, but understanding its causes and following the steps outlined in this guide can help you fix Sage MTD Errors/Error 403 efficiently. We recommend you regularly maintain and monitor your Sage software and HMRC account to prevent future errors. However, if you continue to experience issues, consider reaching out to our Sage support for further assistance. Call us via Live Chat Support!

Frequently Ask Questions (FAQs)

Sage MTD Error 403 indicates a forbidden access issue due to incorrect permissions or authentication problems.

To resolve Sage MTD Error 403, ensure your HMRC credentials are correct and that your Sage software is properly authorized.

You might encounter Sage MTD Error 403 if your HMRC credentials are not set up correctly or if your Sage account lacks the necessary permissions.

Yes, Sage MTD Error 403 can occur due to network issues affecting the connection to HMRC servers.

To prevent Sage MTD Error 403, regularly check and update your HMRC credentials and ensure your Sage software is up to date.