Cash flow is the lifeline of any business. The more congested channels, the more it will affect your business health. A healthy cash flow for your business simply means that you pay your employees, vendors, and suppliers on time. No doubt, there are millions of ways to produce a cash flow statement; however, producing a well-balanced cash flow statement is a crucial task. A well-balanced statement helps you understand the financial position of your company in a better way. Sage helps you in monitoring the cash flow of your organization. Read this complete blog to have a clear picture of cash flow in Sage 50.

Table of Contents

ToggleWhat Does Cash Flow Statement in Sage 50 Mean?

A cash flow statement is typically a financial statement that provides the summary of the amount of cash flow entering and leaving the company. It mainly highlights how well a company uses its cash position to pay its debts and how it generates funds to operate its expenses. The cash statement can be calculated directly and indirectly. In simple terms, the cash flow statement in Sage 50 simply helps you understand your business’s financial health. In short, it is the amount of cash in hand a business has to pay its bills, operate, and invest in its growth. It will uncover the unexpected problem and also inform you whether the business’s healthy bank account is from sales, debt, or other financial accounts.

Structure of Cash Flow in Sage 50

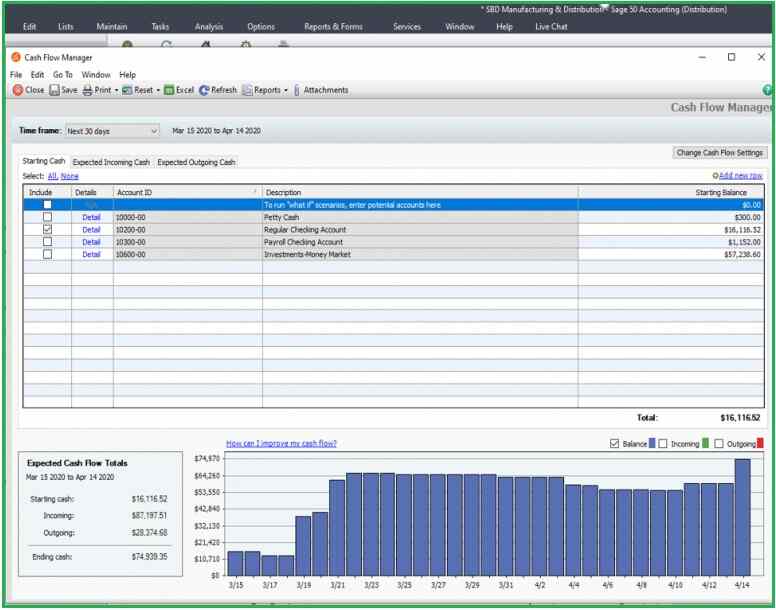

Sage 50 is an effective cash flow management system that produces a well-balanced cash flow report in Sage 50. Normally, it tracks, monitors, and analyses the cash flow to produce the cash flow statement. An effective cash flow statement will help businesses predict how much money they have to cover expenses, payrolls, and debts.

Normally, the cash flow statement of a business differs from organization to organization depending upon its type; however, the main components of a cash flow statement consist of the following:

Cash Flow from Operating Activities

Usually, it describes the money flow from ordinary operating activities such as production and sale of goods. In simple terms, it represents the amount of money a business generates from a company’s service or production and whether they have enough funds to pay the business bills or expenses.

Normally, the operating activities include the following:

- Rent payments

- Income tax payments

- Interest payments

- Receipts from sales of goods and services

- Salary and wage payments to employees

- Payments made to suppliers of services and goods used in production

- Any other type of operating expenses

Cash Flow from Investing Activities

It refers to the cash used for the long-term investment. Usually, it will depict the company’s capital expenditure and its ability to grow.

Normally, the investing activities include the following:

- Purchase or sale of a property.

- Investment in other companies

- Purchase or sale of equipment, plant, or other item used in the company.

Cash Flow from Financing Activities

It usually demonstrates the amount of cash that is used to fund the business and its working capital.

Normally, it includes the following activities:

- Cash from Investors and Banks

- Cash paid to shareholders

- Payments from stock repurchase

- Dividends, repayment of loan

Different Terminologies Used in cash flow sage 50 accounts

The cash flow sage 50 accounts usually consist of the following terminologies. Usually, the values calculated for the cash flow statements are from the receipts or the payments that are already paid.

- Net Balance: It is the remaining amount that is left after all the adjustments and refunds have been calculated after a particular period of time.

- Cash Flow Out: It simply describes the amount of cash that is transferred out from a company. Usually, it contains the total value of money out, the bank transfers, customer refunds, vendor payments, and other expenses.

- Closing Balance: The closing balance is usually the credit or the debit balance of a ledger account in the Chart of Accounts after the end of an accounting quarter or year. Normally, this closing balance becomes the opening balance for the next accounting period.

- Owed to others: In case you have any tax liability, it is shown here. The amount that you need to pay to others will be reflected in this section.

- Cash Flow In: It is the amount of cash that comes into the organization. It simply includes the total amount of your money in your bank transfers and deposits, vendor refunds, customer receipts, and other income sources.

- Opening Balance: It is the total amount that a company has at the beginning of a specific period of time. Normally, it is the resulting balance after paying the start-up expenses and pre-operating expenses.

Why does the Cash flow statement in Sage 50 Essential for Businesses?

The cash flow report in Sage 50 is more than just simply a financial report stating cash flow in and cash flow out. It is one of the important financial statements issued by the company and helps the business in making well-informed decisions based on the facts. By simply looking at the financial cash flow statement, you can easily understand the current cash holding of an organization.

Usually, the cash flow in Sage 50 helps businesses in the following:

- Small businesses can make well-informed and better decisions.

- They can have a look at where their money is spent.

- You can easily predict the future cash flow projections.

- The changes in liability, equity, and assets can be easily detected.

- It depicts the liquidity of your business. So, the business owners can easily know what they can afford and what they can not.

How to Produce a cash flow in Sage 50?

The cash flow report in Sage 50 can be easily produced by following the below-mentioned steps.

- To begin with, sign in to your Sage 50 account by using your admin credentials.

- After that, go to the reports section and then click on the cash flow statement.

- Next, you need to enter the date range for which you wish to view the cash statement.

- Moving ahead, click on the bank account menu and select the bank that you wish to include in the statement.

- Further, click on the calculate button to produce the cash flow statement.

- You can use the export menu tab to save or print the report as a CSV file.

How do you enter cash payments in Sage 50?

Hopefully, now, you are aware of the cash flow in Sage 50. Now, if you are looking forward to how to enter cash payment in Sage 50, then below, we have explained the method in simple terms. However, before proceeding to the method directly, let us understand what a cash payment is.

Usually, a cash payment represents the bill paid by the recipient of goods to the service provider.

To add a cash payment in Sage 50 or to add a cash invoice, follow the below-mentioned steps:

- To begin with, log in to your Sage 50 account by using your admin credentials.

- After that, go to the accounts payable and then select A/P transactions, followed by payment entry.

- Now, choose an existing payment batch with the help of a batch number field or create a new batch.

- Moving ahead, press the Create New entry button and enter the description for the new payment.

- Further, select the transaction type as miscellaneous.

- Mention the vendor name in the vendor name field if the payment is for an existing vendor. Fill in the appropriate details as needed.

- Further, enter the distribution details as needed. Press the taxes button to change the taxes calculated.

- Click on the rates button to change the exchange rate and type. Please note that the rate button only appears when the vendor does not use the functional currency. \

- Lastly, click on the Save button when finished.

What are the Benefits of Using a Cash Flow Statement?

The cash flow statement helps businesses thrive. You will get a better gain of your business finance insights and avoid slipping into the negative finance territory.

The cash flow report in Sage 50 benefits the businesses in the following manner.

- Deep Insights: The cash flow report will help you by providing the proper figure of your cash flow in and out from the various departments of your business. You can easily predict the achivements of your company.

- Easy Tracking: The businesses will get the proper details of what payment the company needs to pay to their vendors, suppliers, employees, or other parties. It helps the company in the long run as you do not miss any payments.

- Improves Short-term Planning: Businesses of all sizes, shapes, and sectors use cash flow statements as a vital tool around the world. It will provide sufficient knowledge of whether the company has sufficient funds to operate optimally in the near future. Business owners can utilize this information to make effective business plans for both the short term and the long term.

- Future Finance Forecast: As stated earlier, the cash flow in Sage 50 will provide the necessary financial statements. By comparing the previous year’s reports, the business owners can predict the future finances of their business.

Final verdict

A cash flow statement/record is a crucial tool for the organizations to have deep insight into their business finances. Whether you are a small business owner, an investor, or a large enterprise, having a cash flow statement is essential as it provides detailed information on how the company spends and makes in the near future. Hopefully, this blog helps you in explaining the various aspects of cash flow in Sage 50. However, in case you still need further assistance, you can get in touch with our experts immediately.

Frequently Asked Questions (FAQs)

Yes, Sage 50 comprises a cash flow report that comes as an in-built utility. You can find it under the analysis taskbar.

A cash flow statement, also known as a cash flow report, is a financial book that summarizes the amount of cash flows in and out of the company. In short, it provides detailed insights into the company’s financial health. They will look at how funds are moved within the organization and what impact it brings on the business.

The cash flow and fund flow statements are the two different entities during a specific period of time. The cash flow will record the company’s inflow and outflow of the actual cash, while the fund flow will record the movement of cash in and out of the company.

Yes, our experts are highly experts in their domain. They will assist you in clarifying the various Sage issues, such as Sage errors, implementation, installing, uninstalling, and more. All you need is to call them or email your problem. They will get back to you with an effective solution.

The below-mentioned steps will help you in posting a cash payment in Sage.

- Log in to your Sage account and then click on the bank accounts tab.

- Further, select the required bank account and then press the supplier payment or customer receipt.

- Next, choose the required customer/supplier and enter the date.

- Ahead, add the required amount in the amount box and click on the Save button.