In the ever-evolving landscape of financial management, efficiency is paramount. For businesses of all sizes. So, managing accounts payable (AP) processes can be both time-consuming and error-prone. Fortunately, with the advent of advanced technology, automation has emerged as a game-changer in this realm. Now, among the leading solutions in this domain is Sage Intacct AP Automation. Now, Offering a comprehensive suite of tools designed to streamline and optimize AP workflows.

Are you looking for professional assistance and technical help while using the AP Sage Intacct automation? If so, you can have a one-on-one conversation with our support team at +18664300630.

Table of Contents

ToggleWhat Does the Sage Intacct AP Automation Include?

Sage Intacct AP Automation is a cloud-based solution that revolutionizes the way businesses manage their accounts payable functions. By leveraging automation, machine learning, and advanced analytics, on the other hand, Sage Intacct empowers organizations to transform their AP processes from cumbersome to streamlined. Hence, enabling them to save time, reduce costs, and mitigate risks.

Why Switch to Sage Accounting Intacct AP Automation

Introduction of Sage accounting Intacct AP automation is all about easing and streamlining the accounts payable processes. Although, Traditional AP processes are often plagued by a myriad of challenges. Hence, Manual data entry, paper-based invoices, and disjointed approval workflows can lead to delays, inaccuracies, and inefficiencies. Moreover, the lack of real-time visibility into financial data makes it difficult for businesses to make informed decisions promptly.

Below, we have jotted down the exciting benefits and key features of Sage Intacct AP automation software:

- Invoice Capture and Processing: This Intacct AP Automation Sage feature automates the capture and processing of invoices, eliminating the need for manual data entry. Using optical character recognition (OCR) technology. Hence, the system extracts relevant data from invoices accurately and efficiently, reducing the risk of human error.

- Workflow Automation: With Sage Intacct, businesses can create customizable approval workflows tailored to their specific needs. Whether it’s routing invoices for approval based on predefined rules or automating recurring payments. Hence, This Sage Intacct AP automation software streamlines the entire AP process, from invoice receipt to payment.

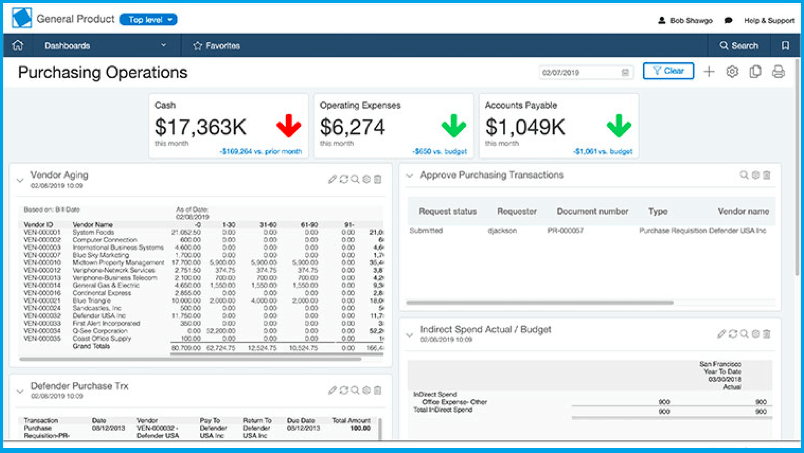

- Real-time Visibility and Reporting: Sage Intacct provides real-time visibility into AP metrics and KPIs. Empowering finance teams to track invoice status, monitor spending trends, and identify areas for improvement. Hence, Its customizable dashboards and robust reporting tools enable businesses to gain actionable insights into their financial operations.

- Vendor Management: Efficient vendor management is critical for optimizing AP processes. This sage Accounts payable automation technology centralizes vendor information facilitates communication, and streamlines payment processing. Together, it fosters stronger business relationships with suppliers while ensuring compliance and accuracy.

- Integration Capabilities: Sage Intacct seamlessly integrates with other business systems, including ERP, CRM, and procurement platforms, enabling seamless data flow and eliminating silos. Now, Integration with leading payment processors further enhances efficiency by automating payment execution and reconciliation.

- Analytics and Reporting: With this key feature, business people gain valuable insights into their AP performance with robust analytics and reporting tools. So, AP automation connects to Sage provides real-time dashboards and customizable reports. So, Allowing you to track key metrics, identify trends, and make data-driven decisions to enhance efficiency and control.

- Enhanced Efficiency: Absolutely! With this advanced AP automation technology, businesses can enjoy enhance efficiency and optimum growth. So, its reduced manual intervention leads to faster processing times Additionally, automate workflows minimize errors and ensure compliance with policies and regulations. Apart from this, the AP automation connects to Sage also streamlines communication with vendors and accelerates resolution of issues and disputes.

Also Read: Sage 100 Crystal Report Error 200

How to Set Up Sage Intacct AP Automation Software?

Setting up Sage Intacct AP Automation software involves several steps to ensure a smooth implementation and configuration:

Step: Planning and Preparation

- Assess Current AP Processes: The first step is to evaluate your existing accounts payable processes to identify pain points, inefficiencies, and areas for improvement.

- Define Objectives: Now, you must determine your goals and objectives for implementing Sage Intacct AP Automation, such as reducing processing time, improving accuracy, or increasing visibility.

- Gather Requirements: Although, start compiling a list of requirements for the software, including integration with existing systems, user permissions, approval workflows, and reporting needs.

- Identify Stakeholders: Now, end this preparation by identifying key stakeholders involved in the AP process, such as finance team members, IT personnel, and department heads.

Step: Software Installation and Configuration

- Subscription and Access: Continue to purchase a subscription to the Sage software Intacct AP Automation and obtain access credentials.

- System Configuration: In the next step, configure system settings, including company information, user roles, permissions, and preferences.

- Integration Setup: Hence, If integrating with other systems (e.g., ERP, CRM), configure integration settings and establish data connections.

Step: Data Migration and Setup

- Data Migration: Import existing vendor, invoice, and payment data into the Sage software Intacct AP Automation. Ensure data integrity and accuracy during the migration process.

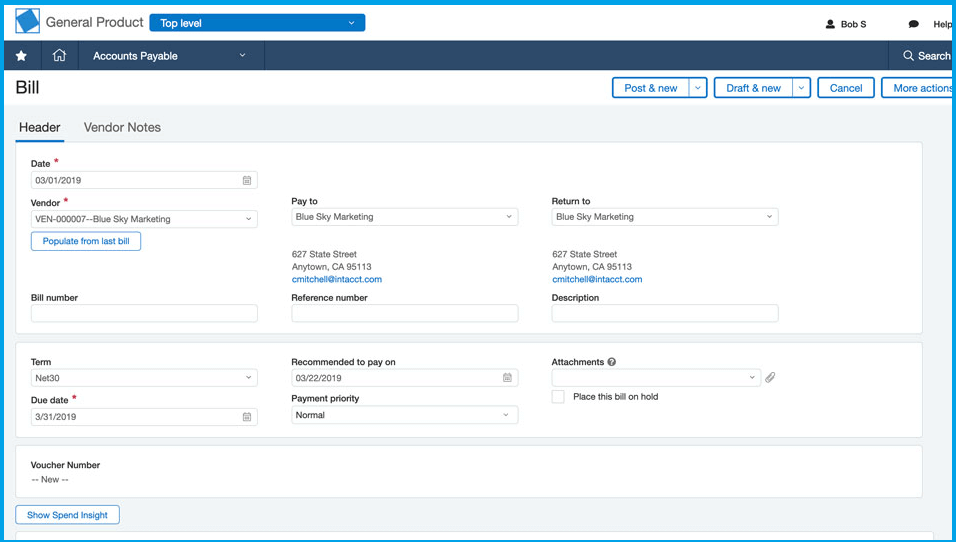

- Vendor Setup: Here, vendor profiles are set up in the system, including contact information, payment terms, and banking details.

- Invoice Templates: Now, customize invoice templates to match your organization’s branding and formatting requirements.

Step: Workflow Design and Approval Routing

- Workflow Configuration: Start designing and configuring approval workflows based on your organization’s approval hierarchy and business rules.

- Approval Routing: In the end, you must define routing rules for invoices based on criteria such as dollar amount, vendor, or department. Hence, Set up notifications for approvers to expedite the approval process.

What Issues Can Occur With Intacct AP Automation?

Now as we have to learn about the key features and benefits of Sage software Intacct AP Automation, now let’s have a quick look at the possible issues that you may come across while using the software.

- Integration Problems: Sage software Intacct AP Automation may encounter difficulties integrating with other systems or software your organization uses, such as ERP systems or banking platforms. Hence, Integration issues can lead to data syncing errors or incomplete automation workflows.

- Data Entry Errors: If data is entered incorrectly into the system, it can cause issues with processing invoices, payments, or other AP-related tasks. Hence, this can result in payment delays, incorrect financial reporting, or reconciliation problems.

- Workflow Problems: Inefficient workflows or bottlenecks in the Intacct AP Automation process can slow down operations and lead to delays in invoice approvals, payments, and vendor communications.

- Customization Challenges: Organizations may require customization or configuration of Sage Intacct AP Automation to meet their specific business needs. Consequently, the Issues can arise if customization is not implemented correctly or if it conflicts with other system functionalities.

- Reporting and Analytics Limitations: If Sage Intacct AP Automation lacks robust reporting and analytics capabilities, it can be challenging for organizations to gain insights into their AP processes and identify areas for improvement.

- System Performance: Also, Slow system performance or downtime can disrupt AP processes and impact productivity when AP automation connected to Sage. Now, it’s essential to monitor system performance and address any issues promptly to minimize disruptions.

- Vendor Support Issues: Hence, Difficulty in obtaining timely support or assistance from Sage Intacct or third-party vendors can prolong issue resolution and impact the overall user experience.

How Can Users Fix Issues with Sage Intacct AP Automation?

Encountering problems like the above in Sage Intacct AP Automation software can be frustrating, but you can troubleshoot and resolve them with the following tricks:

- Read the Error Message & Follow the Instructions: Carefully read and note down the error message you’re receiving. It will often give some clues to learn about what went wrong.

- Use the Current Sage Version: Ensure that you’re utilizing the most recent version of the Sage software program. Sometimes, errors are fixes in newer versions, so updating might resolve the issue.

- Verify Data Integrity: Check the integrity of the data is on process. Now, Errors can sometimes arise from incorrect or incomplete data entry. Make sure to check that all required fields are filled out correctly.

- Check Debugging Tool: If possible, access any logs or debugging tools provided by the software to get more detailed information about the error. This can help pinpoint the cause more accurately.

- Verify Correct Intacct AP Automation Settings in Sage: Although, Review the configuration and settings of the AP Automation module in Sage Intacct. So, Make sure everything is set up correctly according to your business needs and the software’s requirements.

Contact Our Sage Support Team..!

In today’s fast-paced business environment, optimizing accounts payable processes is essential for driving growth and maintaining a competitive edge. Now, Sage Intacct AP Automation offers a comprehensive solution for businesses seeking to streamline their AP workflows, enhance visibility, and improve financial performance. Hopefully, the insights and information above have helped you learn about this innovative Sage technology. For further details, you are free to contact us via Live Chat Support!

Frequently Ask Questions (FAQs)

The accounts payable is the component of the General Ledger in Sage or any other business software that stores all the vendors’ related data. Through Accounts Payable, it is determined how much a company owes to its vendors and other suppliers.

The Accounts Payable automation can be defined as an application or a way through which users can enhance various functions to manage their vendors, suppliers, and their related financial data in the form of invoices, bills, payments, and many others.

Accounts payable simply indicate or store information related to the company’s vendors and other suppliers. The information stored will be in the form of Invoices, and bills. Also, other transactions that are made between the company and its various suppliers.

Accounts payable only seem easy to handle. However, it can be a bit hectic with the number of transactions made with various vendors along with other details like resources, rates, quantity, and many others. Without AP automation features, users need to manually enter these details, having a favorable chance of error leading to severe consequences.

Through the Automation of Accounts, users can easily automate/enhance basic tasks like data entry, easy processing, real-time data access, and many others. All these factors easily boost productivity and eliminate the chances of human error.

AP Automation software can easily boost the working of various accounts payable/Receivable and many others. It also minimizes the occurrence of any fraudulent activity like double bill payment, multiple invoices for the same consignment, and many others. Therefore, AP automation is highly beneficial for saving time as well as company costs.

The two solutions for AP automation in Sage involve Sage 50 and Sage Intacct, which can easily integrate with various AP automation software available on the market.

With the availability of various Automation applications, users need to choose the one offering the following amenities:

- Real-time Data

- Cash Flow Management

- Easy integration with bank accounts and other components.

- Easy option to handle vendor management.

The features of Account Payable Automation streamline various manual tasks, which ultimately reduces the dependency on the human workforce and saves crucial time that can be utilized on other activities.

Common components of the daily operations that can be easily enhanced through Sage Accounts Payable Automation include:

- Invoice generation, approval, and easy tracking.

- Fraud detection, such as double payments, late payments, or duplicate invoices.

- Eliminate the need for manual entry through data being picked up from the source directly and updated from time to time.

- Real-time access to data.